China Nature Watch: Corporate Biodiversity Pressure Assessment 2021

Biodiversity is the basis for human survival, civilization, and economic development. With about 1 million species on the verge of extinction, global biodiversity loss is one of the greatest challenges to humanity. More and more people have become aware of the urgency of this situation, and strive to reach a consensus on reversing biodiversity loss. Therefore, it is essential for society to transform our unsustainable development methods and promote the mainstreaming of biodiversity. This means that biodiversity should be effectively integrated into our politics, economy, culture, and daily lives. Enterprises and financial institutions, as important participants in society, play a prominent role in biodiversity mainstreaming.

Economic development depends on and also impacts biodiversity. On the one hand, economic activities rely on the ecosystem and biodiversity; according to the World Economic Forum (WEF), more than half of the total global GDP is moderately or highly dependent on biodiversity. On the other hand, unsustainable economic activities, such as over-exploitation and pollution, damage the ecosystem and biodiversity. According to the Global Assessment Report on Biodiversity and Ecosystem Services, the five main drivers of biodiversity loss caused by human activities – changes in land and sea use, direct exploitation of organisms, climate change, pollution, and invasion of alien species – are directly or indirectly related to business production and operations. Among these, change in land use is the most significant. However, financial institutions rarely address business impacts on biodiversity, leading to financial activities that accelerate biodiversity loss.

Development that over-relies on and damages nature brings direct or indirect risks to enterprises’ business activities and financial investments. Based on the channels through which biodiversity interacts with the financial system, biodiversity risks can be roughly divided into physical risks and transition risks. Physical risks arise mainly from the degradation of ecosystem services that economic activities and financial assets depend on, and are ultimately transmitted to financial institutions through investment. Transition risk occurs when enterprises and financial institutions fail to align with biodiversity regulatory policies, technological innovation, changing consumer preferences, and other factors in the process of achieving sustainable development.

As biodiversity conservation has become a global issue, the post-2020 global biodiversity framework negotiated at the 15th Conference of the Parties to the Convention on Biological Diversity (CBD COP15) requires enterprises to monitor and report their impacts on biodiversity, in order to reduce their negative impacts. In recent years, China has elevated biodiversity conservation to a national strategy, and increasingly improved the integration of biodiversity conservation into institutional systems. More than 20 biodiversity-related laws and regulations, including the Environmental Protection Law of the People’s Republic of China and the Law of the People’s Republic of China on the Protection of Wildlife, have been implemented. These provide the legislative and regulatory basis of biodiversity conservation in crucial areas such as ecological conservation redlines, protected areas, and important wildlife habitats. These also specify the environmental compliance requirements for enterprises’ construction projects. In addition, illegal enterprises have been severely punished through conservation actions such as the Central Ecological and Environmental Protection Inspection and Green Shield Initiative. As the biodiversity conservation system continues to be upgraded, enterprises will be to adjust their own business models and strategies. If enterprises and financial institutions fail to do so in time, they will face increased transition risks.

The integration of biodiversity conservation into investment decision-making is highly dependent on extensive databases and executable methodologies.

In order to protect biodiversity and reduce transition risks, enterprises and financial institutions should fully understand the prevalence and severity of the pressures on biodiversity exerted through business production and operation, and take corresponding measures to reduce their negative impacts. However, until now, most enterprises still lack biodiversity-related knowledge and the capacity to identify corresponding risks, which makes it difficult to recognize and quantify their pressures and impacts on biodiversity.

A number of international institutions have developed scientific and comprehensive frameworks and guidance in response to this problem. For example, the Taskforce on Nature-related Financial Disclosures (TNFD), composed of 34 financial institutions and enterprises, is developing and testing the world’s first complete and unified framework to help enterprises and financial institutions better understand their dependencies and impacts on biodiversity, and manage the related financial risks and opportunities. Meanwhile, in 2021 China’s Ministry of Ecology and Environment issued the Administrative Measures for the Legal Disclosure of Enterprise Environmental Information. These measures require business entities to compile annual and interim reports on the legal disclosure of environmental information, and upload them to a legal disclosure system of enterprise environmental information. Moreover, they introduce new forms of disclosure and stipulate that some listed companies or bond-issuing enterprises must disclose information about ecological environment protection, thus laying an institutional foundation for disclosing biodiversity information. However, to implement the frameworks and improve the system, database platforms, especially those with a large amount of biodiversity data and spatial information, are essential to support decision-making.

At present, enterprises and financial institutions still have obvious shortcomings in practice. it is difficult to gain biodiversity baseline data. Reliable local biodiversity data should cover wild plant and animal species, ecosystems and legally protected areas, and more. However, a multitude of problems often arises during data collection, such as information transparency and various professional and technical requirements. Moreover, without scientific and compatible quantitative methods, enterprises have encountered difficulties in processing and analysing the data. These gaps and challenges have left enterprises and financial institutions in need of relevant solutions in the process of biodiversity conservation.

Corporate Biodiversity Performance Evaluation Project

Shan Shui Conservation Center, building upon years of extensive conservation work in China, initiated the Corporate Biodiversity Performance Evaluation Project (hereinafter “the Project”) in 2021. The Project aims to provide guidance and support for financial institutions to evaluate biodiversity performance of enterprises, and explore solutions of biodiversity conservation supported by financial institutions and business entities. The Project is implemented in partnership with Peking University Center for Nature and Society, Huatai Securities Co., Ltd., Shanghai Minhang District Qingyue Environmental Protection Information Technology Service Center, Guangzhou Green Data Environmental Service Center, Friends of Nature Environmental Research Institute, and Wind Information Co., Ltd.

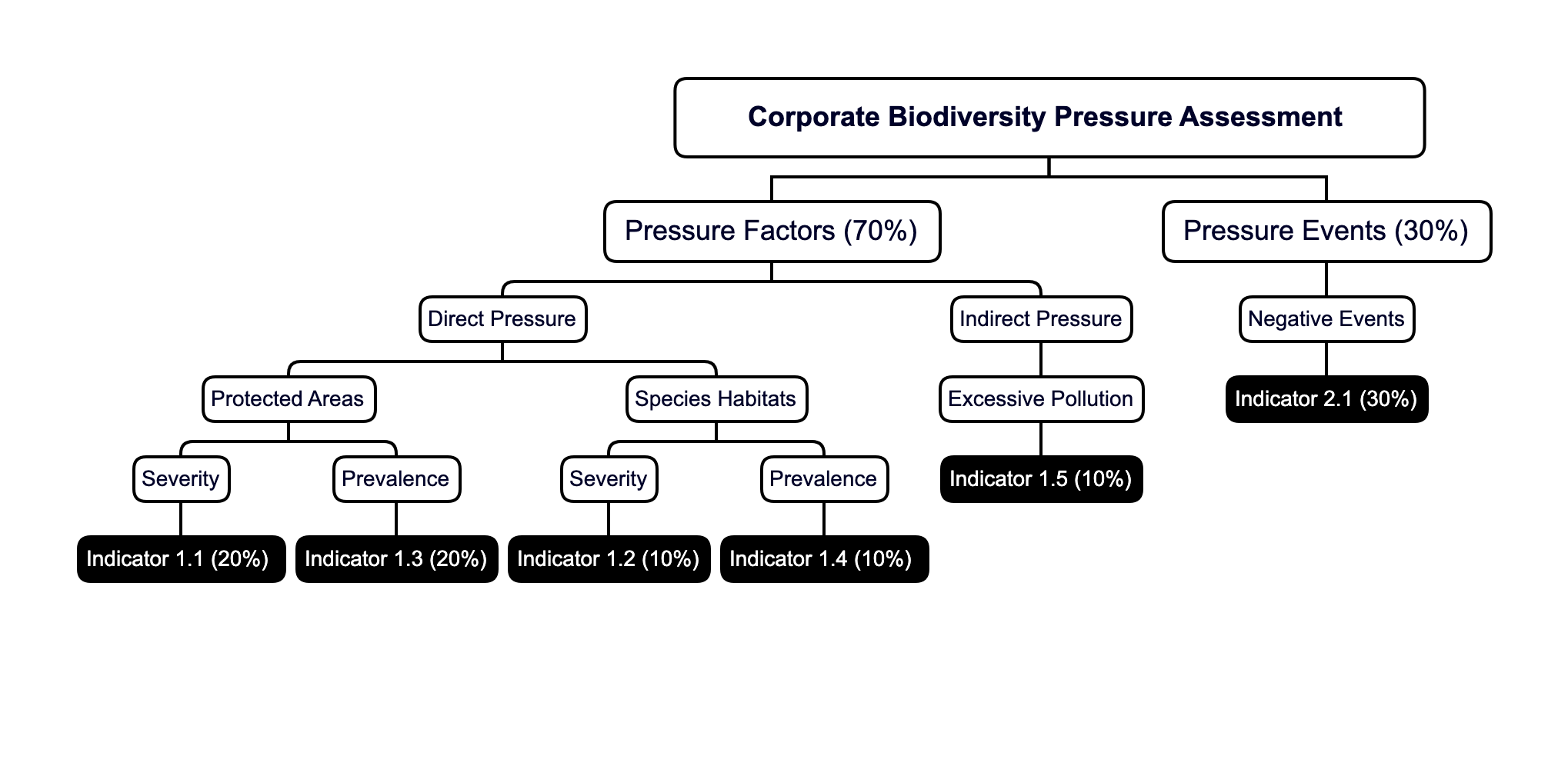

Figure 1: Framework of the Corporate Biodiversity Evaluation System

Pressure Assessment Method

The definition of “pressure” derives from the Pressure-State-Response (PSR) model developed by the Organization for Economic Cooperation and Development (OECD). The model explores the impacts of economic and social activities on the ecological environment, such as environmental damage and disturbance caused by resource exploitation, material consumption, and pollution discharge. This report mainly assesses the pressures caused by corporate production and operation on biodiversity, including changes in land and sea use, direct exploitation of organisms, greenhouse gas emissions, pollution discharge, and invasive alien species. Due to data limitations, this report focuses on evaluating the pressures from land use and pollution on biodiversity. Based on the PSR model and objective third-party data, potential pressures from corporate production and construction on biodiversity can be divided into pressure factors and pressure events (Figure 2), depending on whether enterprises have already exerted negative impacts on biodiversity. In detail, pressure factors refer to various potential pressures identified through data analysis, including direct pressure (e.g. pressure on protected areas and species habitats caused by changes in land use) and indirect pressure (e.g. pressure on biodiversity caused by environmental pollution); pressure events refer to negative information about a company, including environmental penalties and litigation, identified by government regulators or judicial authorities and other agencies.

Figure 2: Specific Indicators of the Framework for the Corporate Biodiversity Pressure Assessment

Pressure Assessment Results 2021

Our evaluation covered 10 industries that have a large impact on biodiversity through their operation and production activities, such as cement manufacturing and mining. Based on the available data, we selected 450 A-share listed companies in these 10 industries as our evaluation subjects. The enterprise data from various databases includes information on the locations of production and construction projects, excessive pollution, and environmental punishment and litigation in 2020. Based on the total weighted score of each indicator, we divided the pressures on biodiversity into four levels: high, medium, low and unidentified.

Compared to non-listed companies, the ecological and environmental information disclosure from listed companies is more systematic and comprehensive. Therefore, our evaluation focused on listed companies in the relevant industries as a representative sample, but it is important to note that our results do not paint the whole picture of these industries.

Figure 3: Assessment Results and Level Characteristics

According to the assessment results, the pressure levels on biodiversity can be divided into four categories: high, medium, low and unidentified. Each pressure level has the following characteristics:

Pressure – unidentified —– Based on the existing data, no business location for a company is in proximity to a nature reserve or habitat of a high-level protected species[1], and the company has no severe environmental penalties or environmental litigation records;

Pressure Level – low —– Based on the existing data, business locations of no more than five subsidiaries of a listed company are in proximity to habitats of high-level protected species; there is no business location in proximity to a nature reserve; and the company has no severe environmental penalties or environmental litigation records;

Pressure Level – medium —– Based on the existing data, business locations of more than five subsidiaries of a listed company are in proximity to habitats of high-level protected species; there is no business location in proximity to a nature reserve; and the company has been imposed severe environmental penalties or is involved in environmental litigation;

Pressure Level – high —– Based on the existing data, business locations of more than five subsidiaries of a listed company are in proximity to habitats of high-level protected species; there are business locations in proximity to nature reserves; and the company has been imposed severe environmental penalties or is involved in environmental litigation.

In this assessment, we extracted the location data of production and construction projects from the Environmental Impact Assessment reports of construction projects , sewage discharge permits, and mining permits published by the government. This data does not fully represent the actual locations of corporate activities; moreover, the results are derived from theoretical calculation based on spatial data, that is, the production and construction projects that are in proximity to crucial biodiversity areas may have potential rather than actual impacts on biodiversity. Despite these limitations, additional attention and investigation should be given to enterprises with potential negative impacts on biodiversity during investment or regulation.

Result 1: Many listed companies in this assessment exerted pressure on national nature reserves and habitats of high-level protected species, and these companies might face transition risks in the case of tightening biodiversity conservation regulations or policies ;

- Among the 450 sampled listed companies in this assessment, 60% were identified as exerting pressures on biodiversity through their business activities. 31% (or 139 companies) were categorized as exerting medium or high pressure, 29% low pressure, and the remaining 40% pressure unidentified (see Figure 3);

- The energy, water, mining, and cement manufacturing industries were generally identified as exerting high pressure on biodiversity and should be given priority attention.

- In the process of achieving the “dual carbon goals”, some clean energy projects were identified as exerting pressures on biodiversity due to improper site selection.

Result 2: Crucial biodiversity areas, including national nature reserves and habitats of high-level protected species, are under significant pressure;

- For more than 1/8 of national nature reserves, business activities such as production and construction were identified within 5km of their boundaries;

- Corporate activities were identified within the habitats of 68 species of national first-class protected wild animals. Moreover, the enterprises located in these habitats might face transition risks in the case of increasing biodiversity-related regulation and policies;

- The biodiversity of rivers, lakes and wetland ecosystems is seriously threatened.

The assessment results show that many of the sampled listed companies have put pressure on biodiversity through business activities such as construction and pollution. More attention to biodiversity conservation is needed in key industries and ecosystems. More extensive data is necessary to support decision-making, avoid negative biodiversity impacts, and reduce the transition risks for enterprises and financial institutions. Accordingly, we suggest the following four key actions:

- The project locations of production and construction for listed companies in this report highly overlap with crucial biodiversity areas. Financial supervisors and institutions should incorporate biodiversity impacts into investment decision-making to avoid transition risks;

- Key industries such as energy, water, mining, and cement manufacturing exert the greatest pressure on biodiversity. Enterprises and investors should not ignore the biodiversity impacts of clean energy projects. In environmental impact assessment guidelines, cement manufacturing should be classified as an ecological impact industry that must comply with stricter biodiversity regulations;

- Rivers, lakes and wetland ecosystems are under severe threat. More stringent risk assessment and constant monitoring of biodiversity impacts for construction projects near rivers, lakes and wetlands are needed.

- Lack of data is a major obstacle to the comprehensiveness of the assessment; therefore, it is essential to further disclose and share the biodiversity data and locations of corporate production and construction projects to lay a solid foundation for multi-stakeholder supervision and early warning of biodiversity risks.

Summary & Outlook

This report is the second ouput of the “Corporate Biodiversity Evaluation System” developed by Shan Shui Conservation Center, following the release of the “Corporate Biodiversity Reporting Evaluation 2021” in April 2021.

Combined with the corporate biodiversity reporting evaluation, this assessment aims to systematically and comprehensively evaluate the pressure on biodiversity caused by corporate activities based on objective, external data. Despite limitations, this study has explored the possibilities of data-driven support for decision-making, revealed the risk factors for sampled enterprises from ten industries, and pointed out the current shortcomings for future improvement. We hope this report can raise more awareness in enterprises, financial institutions, government, and the public for wider cross-sectoral cooperation for biodiversity conservation. With joint efforts and different perspectives, we can collect extensive baseline data and upgrade the evaluation system. In the future, we will also conduct detailed research on key industries such as clean energy, perform more in-depth evaluation, and explore methods to achieve synergies between “dual-carbon goals” and biodiversity conservation targets. While continuous efforts will be required to support the corporate ESG evaluation and risk management of financial institutions, we will keep making contributions, so as to improve biodiversity performance and information disclosure, and accelerate biodiversity mainstreaming in China.

The purpose of this report:

- The spatial use of enterprises’ production and construction projects can exert pressure on and impact local biodiversity. Through scientific measurement methods, we hope to analyze the status of these pressures and impacts;

- Under the increasing urgency to curb biodiversity loss, enterprises and financial institutions should consciously raise awareness of biodiversity conservation and regulate production processes in the spirit of ESG and social responsibility. We hope to provide practical support and guidance with scientific evaluation results;

- At present, the regulatory requirements for biodiversity conservation in enterprises and the financial industry remain insufficient. We hope to put forward policy suggestions based on scientific conclusions;

- Mainstreaming biodiversity conservation requires the collaborative effort of enterprises, financial institutions, regulatory authorities, and conservation agencies. We hope that this report can lead to inter-disciplinary dialogues that explore how to synchronize economic development with biodiversity conservation.

[1] High level protected species refers to wild animals under national first-class and second-class protection, as well as critically endangered species (CR) and endangered species (EN) in the IUCN Red List or Red List of China’s Biodiversity.

read the full report here:link